Property Taxes Made Easy: a 10-Minute Guide

Every year you get a property tax bill. It is a list of:

- The taxable value of your property (not the same as the market value)

- Who you pay property tax to

- How much of your property tax goes to each organization

If an organization wants to change the tax rate, they are legally required to host a Truth in Taxation public meeting. Most of these are held in August, and rarely compete; you should be able to attend every one of them if you desire. (The City of West Jordan’s Truth in Taxation meeting is August 19th starting at 6 PM inside the Council Chambers, 8000 S. Redwood Rd.)

To help you prepare for August’s meetings, here is a quick guide to how property taxes are calculated.

Whether you’re a homeowner, business owner or curious resident, staying informed helps you understand what is happening in your community.

If you have 2 minutes, read steps 1 through 4 to get a basic understanding of the rules.

- Your property tax rate changes every year! Salt Lake County calculates a new rate for each fiscal year (July 1 to June 30), not the City or any other tax collecting organization (i.e. library, school district, mosquito abatement, etc.). See Property Tax Rates .

- If a house’s taxable value (not sale price!) rises, the rate for property tax collected decreases. If a house’s value decreases, the rate rises.

- This guarantees the city doesn’t lose money just because the property value changed.

- This also guarantees property owners won’t be penalized by paying higher taxes because their property value changed.

- See Notice of Property Valuation & Tax Changes for your property evaluation.

- Truth in Taxation is a meeting that a local government must host if they would like to adjust the property tax rate that the County has set for the year.

- If the city announces a tax increase, it is an increase on the existing rate for that year. It is not an increase on your whole bill, nor every property tax organization; It is only on the city’s rate. See the Notice of Proposed Tax Increases for 2025.

If you have another 5 minutes and want to understand more about property taxes, read steps 5 and 6:

- Here’s a video by the Utah Association of Counties that explains how property taxes are calculated. Once you’ve watched the video, come back to learn more.How is Property Tax Calculated in Utah?

- Utah state law guarantees that the city will receive the same amount of property tax money it did the previous year, regardless of the changes in property values within its borders. This is why the County adjusts the tax rate, to keep the income the same.

- If the city collects *$200,000 in one year, they will get the same $200,000 the next year, even if property values have increased by 10%. (*example numbers, not actual income of West Jordan or the actual market increase)

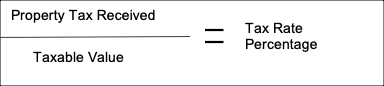

- Here is what that looks like:

If a city receives $200,000 from all residents and businesses in their borders, and the overall worth of those properties is $1,000,000,000, the city’s tax rate is 0.02% of total property value.

If the worth of the properties rises, the rate decreases, but the income for the city remains the same.

If you have 3 more minutes and want a thorough and detailed understanding about all the moving pieces that work together to define property taxes, read steps 7 through 10.

- The County will assess properties every few years and adjust values. Home improvements and changes in the real estate market may increase a property’s value, which means more property tax will be owed. This increase is usually minimal, and can be disputed with the County. File an Appeal

- Primary residential properties only pay taxes on 45% of the value of the property. Secondary and business properties pay taxes on 100% of the value.

- Property taxes are one of the most effective and efficient ways to fund local governments, from police and fire, to snow plows and parks, and libraries and schools.

- Businesses and residential properties share the burden of property taxes. Sometimes the values of one type of property will rise while the other falls.

- If the value of a business property decreases, the residents may pay a little more to keep the city’s income the same as the previous year.

- And vice versa. If the value of residential decreases, the businesses will pay a little more.

If you’ve made it this far, congratulations! You now have a comprehensive understanding of property taxes in Utah. If you have more questions, we suggest continuing your education here: Property Taxes – Treasurer | Salt Lake County